Embarking on a vacation is a thrilling adventure, but the last thing you want is a financial hangover when you return. To ensure your holiday memories are accompanied by peace of mind, mastering the art of tracking your vacation spending is crucial. In this guide, I’ll delve into practical strategies, insightful tips, and innovative tools to make sure your budget aligns with your travel dreams. A vacation budgeting aficionado.

Set the Stage: Crafting Your Vacation Budget

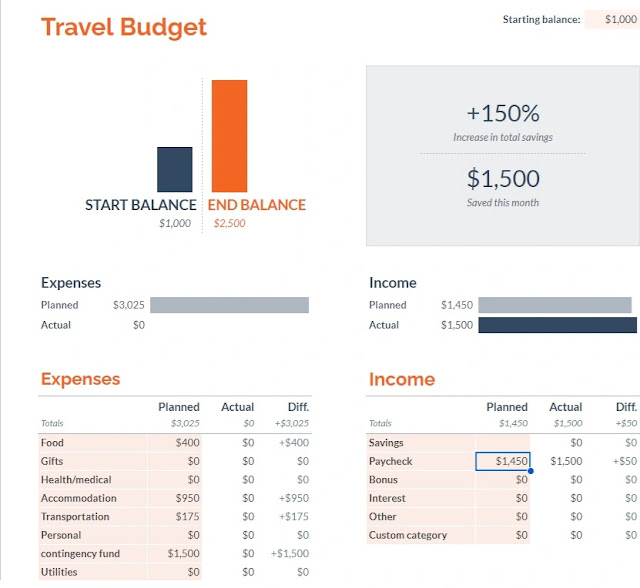

Before you can track your spending, you need a solid budget. Break down your expenses into categories: accommodation, transportation, meals, activities, and a contingency fund for the unexpected. This initial step lays the foundation for a detailed spending plan. It simplifies the process of tracking your vacation spending, making it more manageable and straightforward.

Tech-Savvy Tools: Budgeting Apps and Beyond

Say goodbye to the era of manual calculations and notebooks. Explore the plethora of budgeting apps designed for travelers. From classics like Mint to specialized tools like Trail Wallet, these apps streamline expense tracking, providing real-time insights into your spending patterns.

Cash or Card: The Great Dilemma

The age-old question – should you rely on cash or cards during your travels? I’ll dissect the pros and cons of both. Learn when to use cash for better budget control and when to swipe your card for added security and convenience.

Pros and Cons of Cash:

Pros:

Tangible Control: Using cash provides a tangible sense of control. You physically see the money leaving your wallet, making it easier to manage your budget.

Cons:

Security Concerns: Carrying a significant amount of cash can pose security risks. Losing it means losing your funds with no way to recover them.

Pros and Cons of Cards:

Pros:

Security: Cards offer enhanced security features. Lost or stolen cards can be easily reported and replaced, protecting your funds.

Convenience: Cards are widely accepted globally, offering convenience and eliminating the need to carry large amounts of cash.

Cons:

Overspending Risk: The ease of card transactions might lead to overspending. Without a physical representation of money leaving, it’s easy to lose track.

Navigating the Dilemma:

Understanding the advantages and drawbacks of both cash and cards allows you to make informed decisions based on your travel style and destination. Consider having a mix of both for flexibility.

Daily Check-Ins: Staying on Top of Your Finances

Vacation euphoria can lead to oversights in tracking your vacation spending. Establish a daily routine for a quick financial check-in. I’ll explore simple habits that keep you aware of your budget without detracting from your enjoyment.

The Habit Loop:

Establishing a daily financial check-in creates a habit loop that keeps you actively engaged with your budget. Here’s a simple routine to adopt:

Morning: Review your expenses from the previous day.

Afternoon: Log any midday expenses.

Evening: Reflect on your spending for the day and adjust your budget if necessary.

Tools for Daily Tracking:

Utilize budgeting apps with notification features. They can send daily reminders to log expenses and provide summaries, ensuring you’re always aware of your financial landscape.

Hidden Gems: Unveiling Unexpected Costs

Ever returned from a vacation only to discover unforeseen expenses? Anticipating hidden costs is a game-changer. From sneaky tourist taxes to unexpected transportation fees, I’ll guide you on identifying and preparing for these budget surprises.

Anticipating Tourist Taxes and Fees:

Example: Many tourist destinations impose additional taxes or fees that might not be included in your initial budget. These can include city taxes, resort fees, or environmental fees.

Transportation Surprises:

Example: Public transportation costs might vary based on the time of day or specific routes. Factor in potential peak-hour fees or unexpected route changes.

Navigating Hidden Food Costs:

Example: Some restaurants may add service charges that aren’t explicitly mentioned on the menu. Being aware of local tipping customs can help you budget for these additional costs.

Preparing for Currency Exchange Fluctuations:

Example: Exchange rates can impact your purchasing power. Keep an eye on currency exchange trends and budget accordingly.

By preemptively identifying potential hidden costs, you empower yourself to create a more robust budget that accommodates these surprises without derailing your financial plans.

Splurges vs. Savings: Finding the Right Balance

Vacations are about enjoyment, and sometimes that means splurging on a special experience. Learn how to balance indulgence with practicality, ensuring that your budget allows for both memorable treats and financial responsibility.

Post-Vacation Analysis: Reflecting on Your Spending Habits

The journey doesn’t end when you return home. I’ll explore the importance of post-vacation analysis. Reflecting on your spending habits allows for continuous improvement, shaping future vacations with newfound financial wisdom.

Why Post-Vacation Analysis Matters:

The journey doesn’t conclude when you return home. Take time to reflect on your spending habits during the vacation. Analyzing where your money went allows for continuous improvement, shaping future trips with newfound financial wisdom.

Utilize Budgeting Apps:

Many budgeting apps provide post-travel analysis features. Review your expenses category-wise and compare them against the initial budget. Identify areas where you overspent or saved, aiding in better planning for subsequent vacations.

Adjusting Future Budgets:

Based on your analysis, adjust your future budgets. If you consistently overspend in a specific category, allocate more funds accordingly. This iterative approach ensures that your budgets become increasingly accurate and tailored to your travel style.

Cultural Spending Hacks: Navigating Local Economies

Different destinations come with unique spending landscapes. Uncover cultural spending hacks to navigate local economies without sacrificing your budget. From bargaining tips to understanding tipping etiquette, I’ve got you covered.

Different destinations have unique cost structures. It’s crucial to familiarize yourself with the local economy to avoid overestimating or underestimating your expenses. Research average prices for accommodation, meals, transportation, and activities in your chosen location.

Budget-Friendly Alternatives:

Every destination offers a range of choices, from luxurious options to more budget-friendly alternatives. Consider staying in local guesthouses, exploring street food markets, or using public transportation to save money without compromising your experience.

Cultural Considerations:

Immersing in local culture often comes with its own set of expenses. Whether it’s attending cultural events, trying regional delicacies, or participating in traditional activities, allocate a portion of your budget to these immersive experiences.

Emergency Fund for Unforeseen Expenses:

Even with meticulous planning, unforeseen expenses can arise. Create a separate emergency fund within your budget to handle unexpected costs. This ensures that a minor hiccup doesn’t derail your entire financial plan.

Regularly Updating Your Budget:

During your trip, periodically review and update your budget based on actual spending. This proactive approach allows you to make necessary adjustments, ensuring that you stay within your financial limits while maximizing your travel experience.

Emergency Fund: Your Financial Safety Net

No budget is foolproof, and unexpected emergencies can arise. Explore the concept of an emergency fund tailored for travel. I’ll guide you on how to build and utilize this financial safety net without compromising your vacation plans.

Building Your Travel Emergency Fund:

No budget is foolproof, and unexpected emergencies can arise. Establishing a dedicated travel emergency fund is vital. This fund acts as a financial safety net, providing a cushion for unforeseen circumstances like medical emergencies or sudden itinerary changes.

Determining the Size of Your Fund:

The size of your emergency fund depends on factors like the destination, the length of your trip, and your personal risk tolerance. Aim for an amount that covers potential unexpected expenses without significantly impacting your overall budget.

Smart Utilization of the Emergency Fund:

In the event of an unforeseen expense, use your emergency fund judiciously. This fund is specifically reserved for genuine emergencies, not for impulse purchases or oversights. Maintain a clear distinction to ensure its availability when truly needed.

Rebuilding After Use:

If you dip into your emergency fund, prioritize rebuilding it as soon as possible. This ensures it’s ready for deployment in case of another unexpected situation. Consistent replenishment is key to maintaining the effectiveness of your financial safety net.

Personalized Tracking Methods: Making It Work for You

Finally, I’ll discuss personalized tracking methods. Not everyone fits into the same budgeting mold. Discover techniques that align with your preferences and lifestyle, ensuring that tracking your vacation spending becomes a seamless part of your travel routine.

Tailoring to Your Lifestyle:

Recognize that not everyone fits into the same budgeting mold. Personalization is key to successful tracking your vacation spending. Explore techniques that align with your preferences and lifestyle. Whether you prefer digital apps, spreadsheets, or the simplicity of a travel journal, find a method that resonates with you.

Digital Solutions:

For tech-savvy travelers, various digital tools cater to personalized tracking. Utilize budgeting apps like Mint or YNAB that sync with your accounts for automated tracking. These apps often provide insightful analytics to help you understand your spending patterns.

Old-School Approaches:

If digital tracking feels overwhelming, embrace traditional methods. Maintain a dedicated travel journal where you jot down daily expenses. This tactile approach not only serves as a record but also offers a reflective space for thoughts and memories.

Enlisting Travel Companions:

If you’re not a solo traveler, consider enlisting the support of your travel companions. Shared tracking responsibilities can be both efficient and collaborative. Create a communal tracking system that everyone finds easy to contribute to, ensuring accuracy and transparency.

Integration with Daily Habits:

Make tracking seamless by integrating it into your daily routine. Set aside a few minutes each day to update your budget or log expenses. Consistency is key, and small, regular efforts are more sustainable than sporadic large updates.

Rewarding Yourself for Tracking:

Turn tracking into a rewarding experience. Celebrate milestones in your budget, whether it’s staying within limits for a week or successfully managing unexpected expenses. Positive reinforcement can transform tracking from a chore into a satisfying habit.

Flexibility in Your Approach:

Be open to adapting your tracking methods as needed. Your lifestyle and preferences might evolve, and so should your tracking approach. Regularly assess the effectiveness of your chosen method and make adjustments to enhance its utility.

Incorporating Lessons from Analysis:

The insights gained during post-vacation analysis should inform your ongoing tracking methods. If you identify areas of overspending or realize certain expenses are consistently underestimated, adjust your tracking approach accordingly.

Continuous Learning:

Consider tracking not just as a tool for financial management but as a journey of continuous learning. Each trip provides new insights into your spending habits and preferences. Embrace these lessons to refine your tracking methods for future adventures.

In conclusion, tracking your vacation spending doesn’t have to be a daunting task. With the right strategies, tools, and mindset, you can enjoy your travels without the stress of financial uncertainty. Follow this guide, and your next vacation might not just be a feast for your senses but also a treat for your wallet.

For travel photos, be sure to check out my Instagram at jsone9!